Over the last two weeks, inflation has (unsurprisingly) been the main topic of conversation. With the US recording 9.1% inflation in June of 2022 and Australia recording 6.1% inflation in the June quarter, prices seem to be scared to fall back down and the cost of living doesn’t want to either. In light of these announcements, Treasurer Jim Chalmers has called for the first official independent review of the RBA since 1989. At the same time, the US are reconsidering the definition of a recession and are encouraging everyday citizens to remain positive about the future of the US economy, despite the potential of a recession. This fortnight’s article will analyse the state of inflation in Australia and discuss how COVID-19 has changed the way we explore classic economic concepts and definitions.

The RBA’s review and the long-term outlook of inflation in Australia

As per the Reserve Bank Act 1959, the RBA acts independently from the Australian Government and conducts monetary policy without government interference. Whilst there are requirements for the RBA to consult with the Australian Government, the RBA is solely responsible for the conduct of monetary policy and makes decisions on their own. However, as of last week, Treasurer Jim Chalmers has launched a “major review” of the RBA following criticism of the bank’s interest rate policies.

This independent review wants to analyse how the RBA:

- Sets interest rates

- Manages inflation

- Is accountable for their actions

- Board is appointed

The review will also re-assess the long-standing inflation target of 2-3%, assessing whether this target range is effective and suitable in the current economic climate. As such, this review will also analyse how fiscal and monetary policy interacts.

So, why is the RBA under scrutiny? There are a couple of reasons. Firstly, the RBA failed to achieve its 2-3% inflation target for five years before the pandemic, with underlying inflation remaining below 2% from 2015 until 2021. Secondly, the RBA provided incorrect forward guidance, saying that they had no intention to hike interest rates until 2024. This has created a lot of issues for homebuyers who purchased homes during the pandemic, as they expected no change to their mortgage repayments until a few years later. Finally, the RBA has hiked the cash rate dramatically, increasing rates by 1.0% over the course of the last two monthly meetings.

With inflation set to reach 7%, the RBA are doing everything they can to achieve their 2-3% target. It should be noted that the RBA does not have to consistently achieve 2-3% every single quarter, but need to achieve 2-3% on average over the course of the business cycle. Therefore, it is no surprise that the RBA are taking such an aggressive stance on monetary policy.

However, based on the inflation announcement today, inflation is set to surpass 7% by 2023. Today, it was announced that Australia’s inflation rate reached 6.1%, as Australian citizens pay more and more for food and fuel. Based on this announcement, it is likely that the RBA will hike interest rates once again. Gareth Aird, the Head of Economics at CBA, argues that the cash rate will increase at the board meeting next week. Aird is expecting the RBA to raise the cash rate to 1.85%, meaning another 0.50% cash rate hike is on the way.

Want Economics tutoring? Come enrol in Project Academy’s Economics courses!

Wait… There isn’t going to be a recession?

In Australia, the economy is said to be in a recession if there are two consecutive quarters of economic contraction (i.e. negative economic growth). Australia saw its first technical recession in decades during 2020, as COVID-19 swept the nation and economic growth reached a low of -7%. Surprisingly, Australia did not fall into a technical recession during the GFC. Thus, technical recessions are rare in most advanced economies, as macroeconomic policy instruments have proven effective in minimising the effects of negative economic growth.

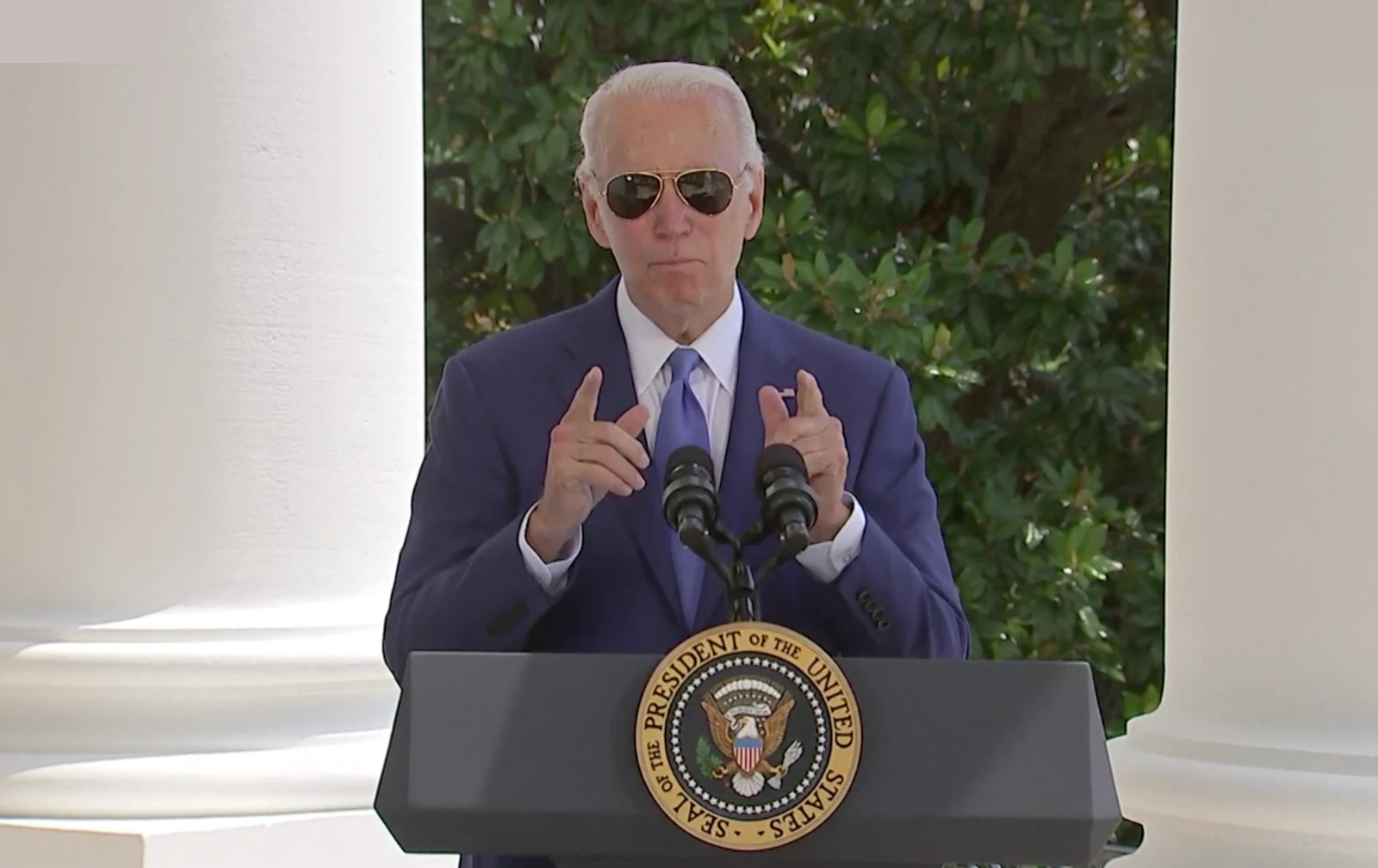

However, in the US, there is an ongoing debate as to whether the above definition is the correct definition for a recession. Yesterday, Joe Biden argued that the US is not heading into a recession. This contradicts current expectations, as notable forecasts are predicting that growth figures will be negative for two consecutive quarters. This should, in theory, signal a recession.

Yet, leading White House representatives insist that the definition of a recession is changing and that the current definition is not the only indicator of a technical recession. National Economic advisor Brian Deese argues that “the most important question is whether working people and middle class families have more breathing room”.

This is a bit confusing. What does “breathing room” mean?

Deese believes that American citizens should not look at GDP figures or inflation figures in isolation. The White House has encouraged American citizens to look towards job growth, industrial output and supply-side indicators. As such, Biden is arguing that the USA is simply shifting from rapid growth to steady growth, as the after-effects of the COVID-19 pandemic settle and economic growth returns to pre-pandemic levels.

Regardless of which definition is the correct definition, this is an extremely interesting argument. COVID-19 has led economists and policymakers to re-think the definitions that have been taught to generations of budding economists. Australia is sticking to its historical definition of a technical recession and is less likely than the USA to experience a nationwide recession. However, if the USA does announce negative GDP growth next week, it could be a sign of things to come for the rest of the world.